when are property taxes due in madison county illinois

The median property tax on a 12260000 house is 214550 in Madison County. Directions to changeupdate scheduled payment information.

Property Taxes By County Where Do People Pay The Most And Least

Madison County has one of the highest median property taxes in the United.

. Thursday is July 7 and that means if you live in Madison County the first installment for paying your property tax bill is due. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600.

EDWARDSVILLE Madison County Treasurer Chris Slusser is reminding taxpayers that the third installment of their tax bill is coming due. These taxing units include cities county school and. Madison County is one of only two counties in the state that offers taxpayers four installments to pay real estate taxes.

Exemptions or Appeals - Call the Madison Chief County Assessment Office at. However for those struggling financially late penalties will be waived as long as the. Yearly median tax in Madison County.

The median property tax on a 12260000 house is 128730 in the United States. Property tax due dates for 2019 taxes payable in 2020. If you are a taxpayer and would like more information or forms please contact your local county officials.

Madison County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. You are about to pay your Madison County Property Taxes.

The exact due date is mentioned on your tax bill. Welcome to Madison County Illinois. Madison County Property Tax Inquiry.

Madison County property owners should see tax bills in their mailboxes sometime next week according to Treasurer Chris Slusser. January 20 2020 - Dr. Illinois gives real estate taxation power to thousands of community-based public entities.

The median property tax also known as real estate tax in Madison County is 214400 per year based on a median home value of 12260000 and a median effective property tax rate of 175 of property value. January 1 2020 - New Years Day. The first installment for property taxes will be due on July 9 however for those struggling financially late penalties will be waived as long as the payment is received by September 9.

Treasurer Chris Slusser tells. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The first installment for property taxes will be due July 9.

Directions for step-by-step processing for paying taxes online. 8 hours agoIf a resident does not have online access or needs assistance her staff is willing to assist property owners. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

173 of home value. Taxes are owed on more than 135000 parcels county-wide. Your taxes are not paid until funds settle into our bank account.

When are taxes due. Martin Luther King Jrs birthday. Property valuation - Call your Township Assessor.

With the due date quickly approaching I want to remind everyone that the third of four tax installments will be due Oct. It is managed by the local governments including cities counties and taxing districts. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

When searching choose only one of the listed criteria. LovingLifePhotography Madison County Treasurer Chris Slusser said property owners should be receiving tax bills soon with the first installment coming due July 8. Madison County Treasurer Chris Slusser announced Tuesday that he plans to offer a two-month grace period for the first property tax payment in order to assist those struggling financially during the COVID-19 pandemic.

Property TaxesMonday - Friday 830 - 430. Madison County collects on average 175 of a propertys assessed fair market value as property tax. The first installment is due in July the second is in September the third in October and the last in December.

The Madison County Treasurer holds its annual tax sale to auction off all unpaid taxes for the current year. Property Tax Reform Report. 618 692-6270 Appeals Call the Madison County Board of Review at 618 692-6210 Tax rates or Tax redemption - Call the Madison County Clerk at 618 692-6290 Tax bills.

The Treasurers Office will continue rolling out paperless delivery of tax bills or e-notice this year. The Treasurers Office reminds if you take advantage of the 4-payment plan you should have that payment in by the end of the day. In most counties property taxes are paid in two installments usually June 1 and September 1.

Madison County Property taxes are paid in four installments. Tax amount varies by county. All other counties offer only two.

General Information and Resources - Find information. Tax Rates and Tax Levy. Still property owners generally pay a single consolidated tax levy from the county.

175 of home value. Do not enter information in all the fields. The Illinois Department of Revenue does not administer property tax.

Taxes are paid in four installments and the first installment is due in July the second is in September the third in October and the last in. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Mendoza is encouraging residents to be sure they received all of their.

For other questions about. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at 430 pm. The median property tax on a 12260000 house is 212098 in Illinois.

A reassessed value is then multiplied times a composite rate from all taxing entities together to set tax due. The County Clerks office is responsible for annually computing the property tax rates for all parcels of land within the county and the redemption of delinquent taxes as well as being the keeper of the records of tax information. Residents may call the Recorders office at 618 296-4488 or visit the recorders office any time during operation Monday Friday 830 am.

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Delinquent Property Taxes Mcco

Illinois Voters Could Eliminate Townships That Share City Limits Under Bill

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax By County Property Tax Calculator Rethority

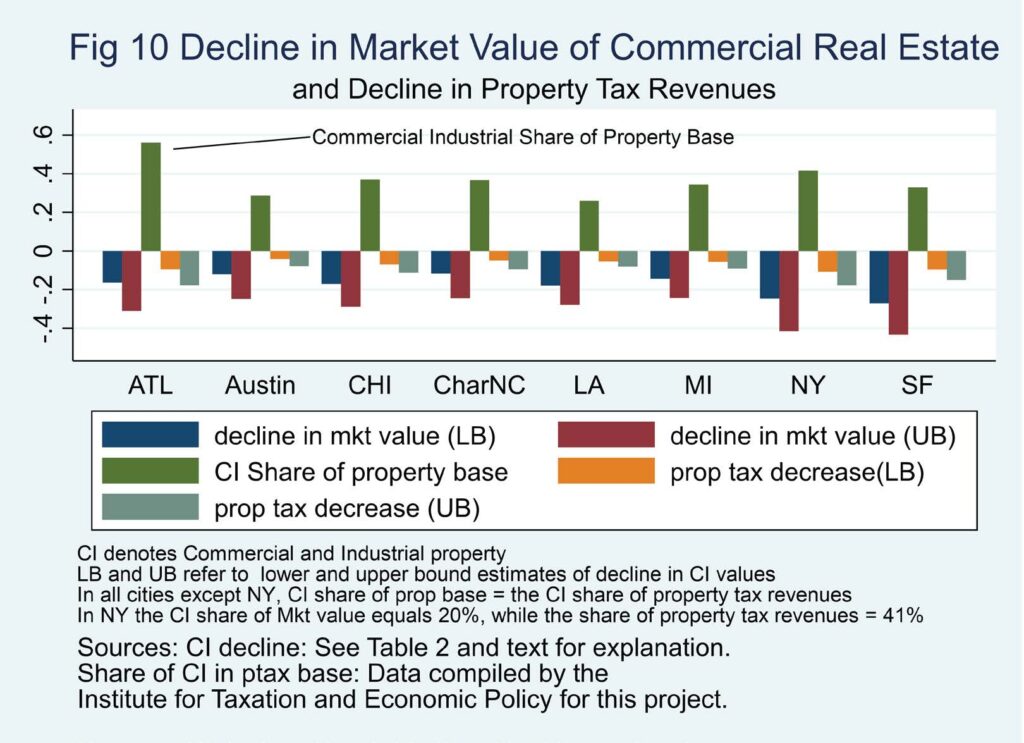

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

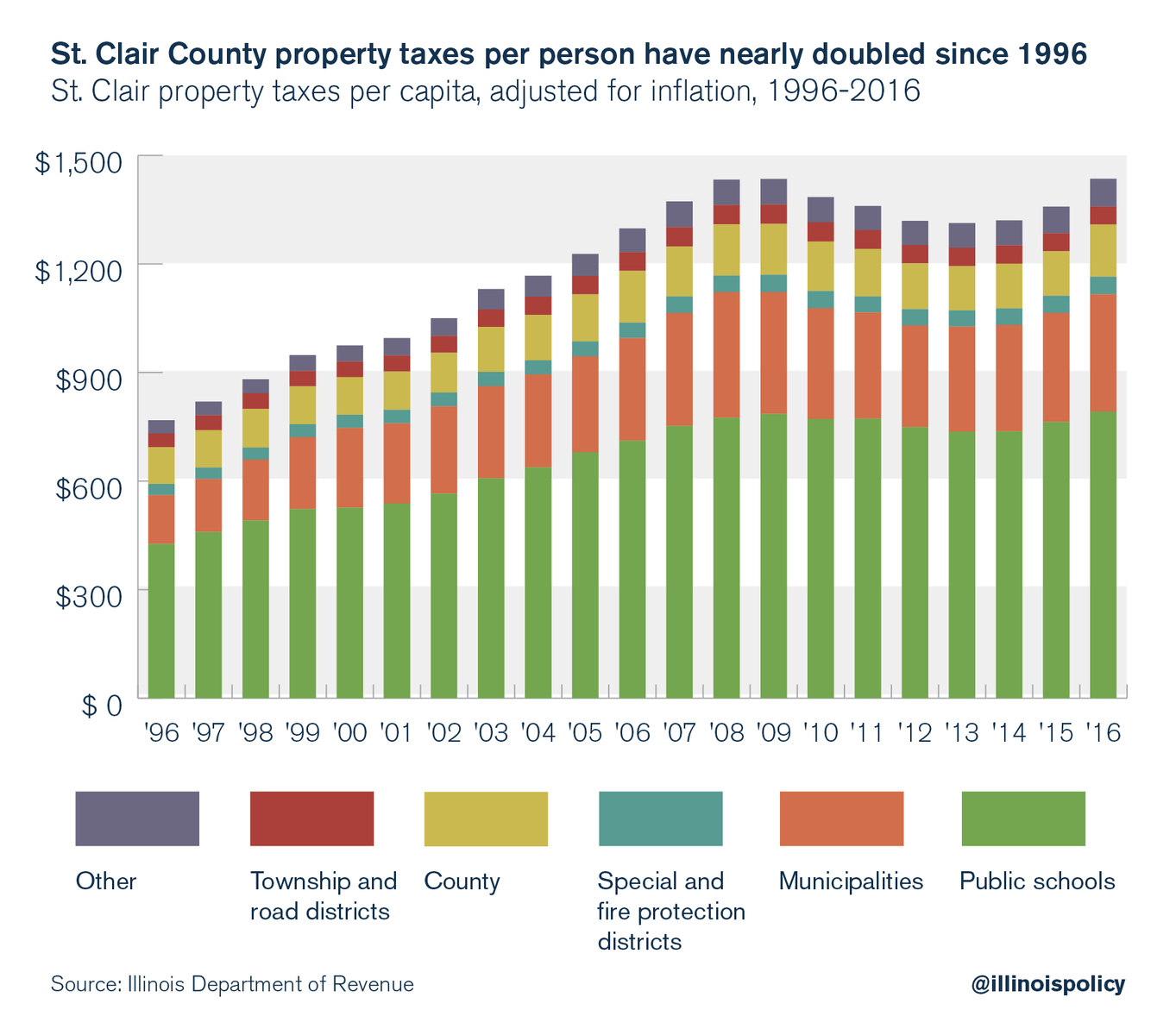

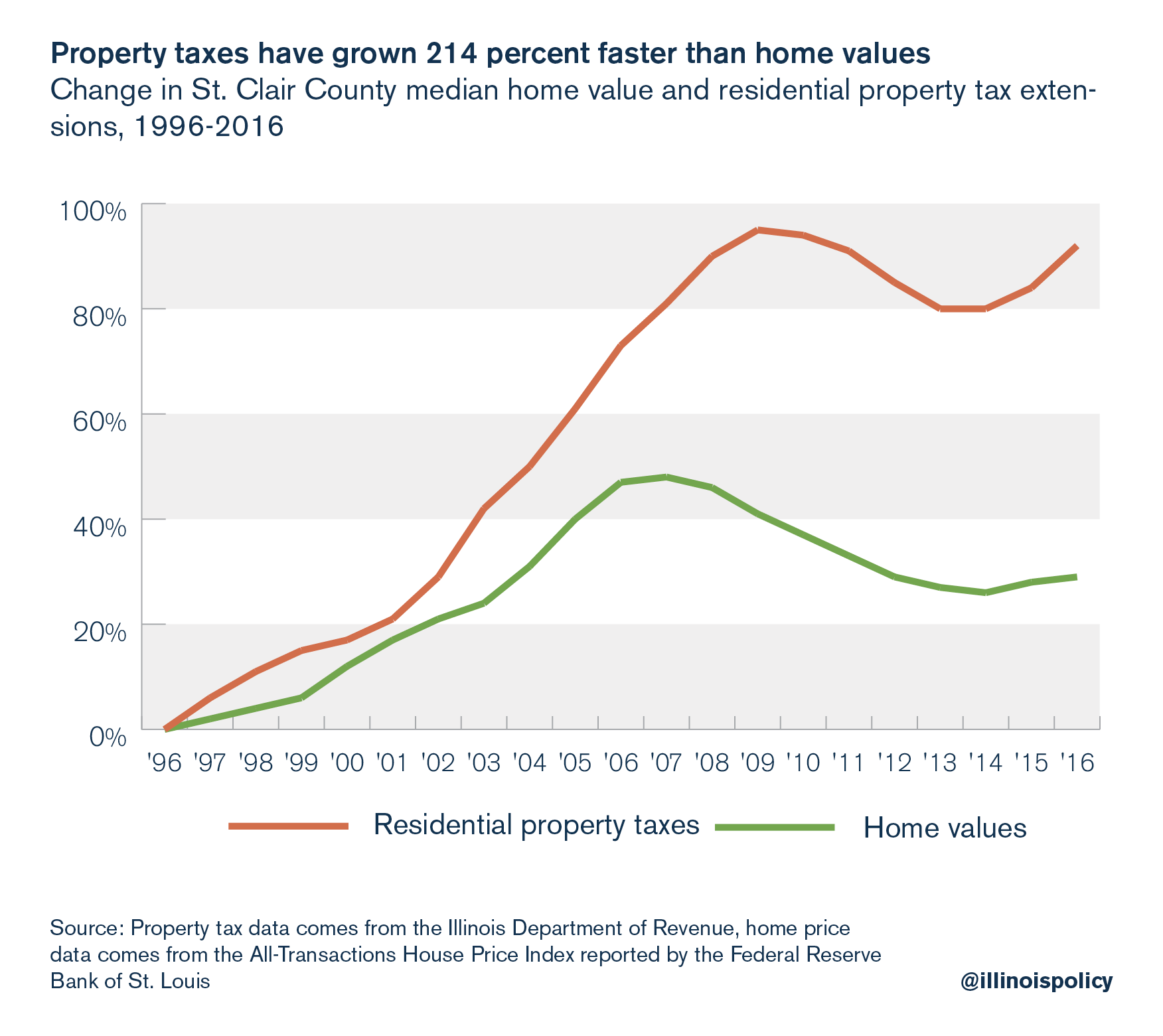

St Clair County Property Taxes Nearly Doubled Over Last 20 Years

Property Tax Village Of River Forest

Property Tax By County Property Tax Calculator Rethority

Illinois Voters Could Eliminate Townships That Share City Limits Under Bill

St Clair County Property Taxes Nearly Doubled Over Last 20 Years

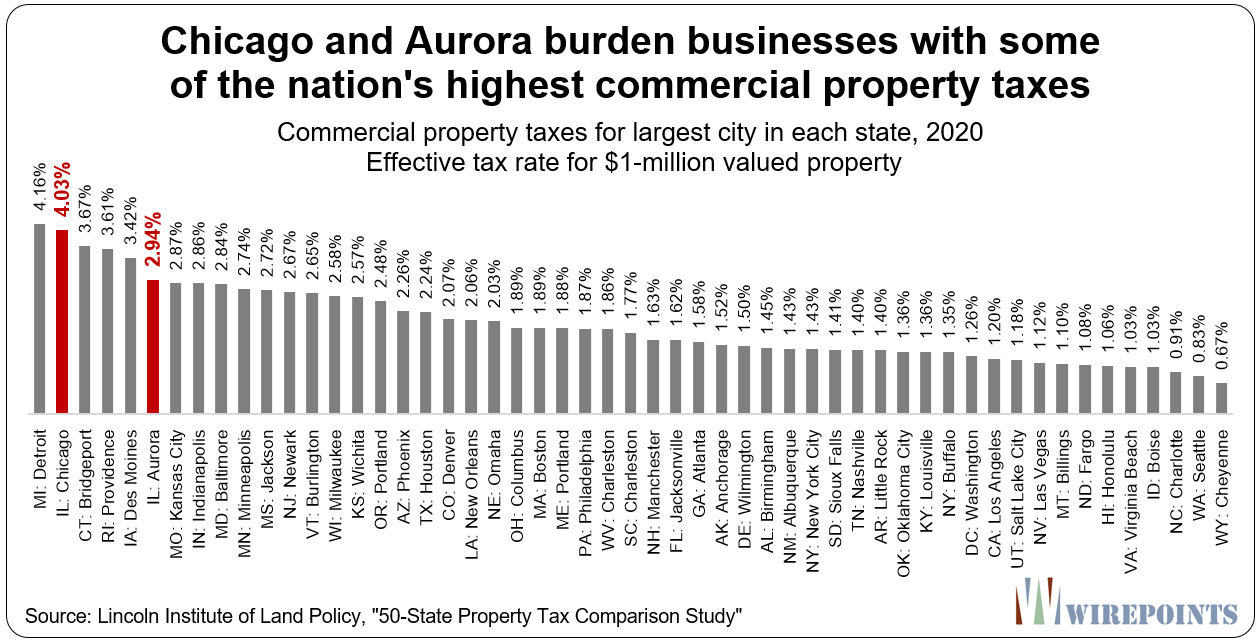

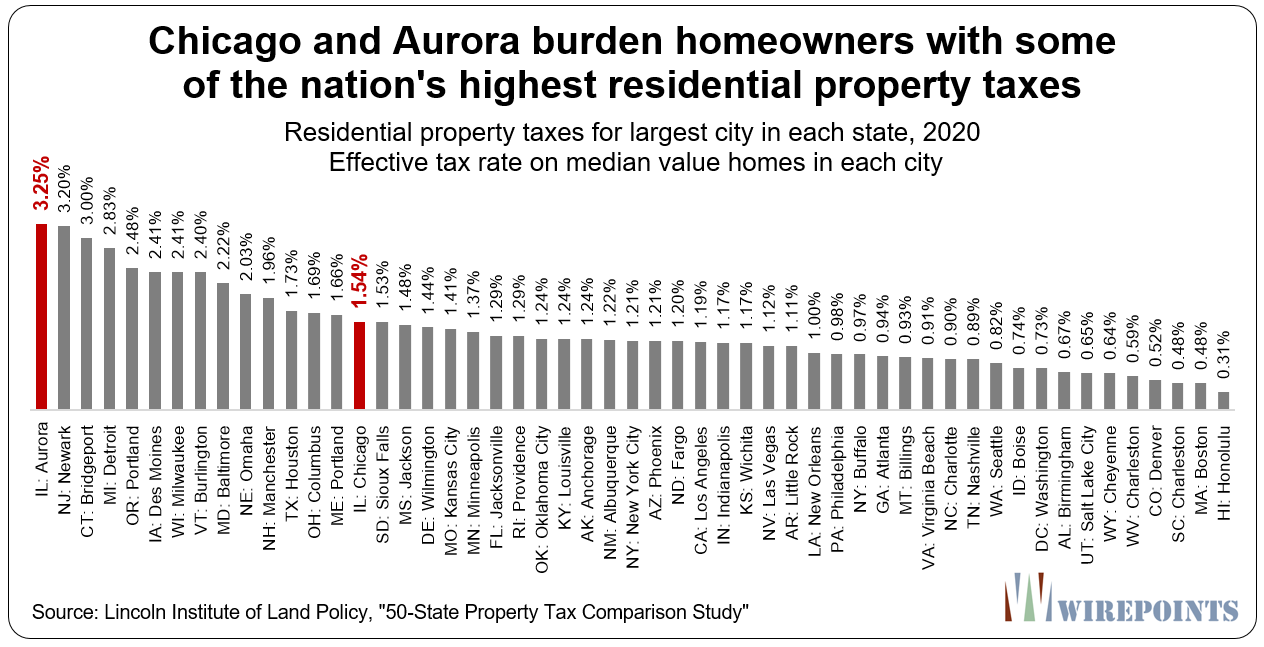

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

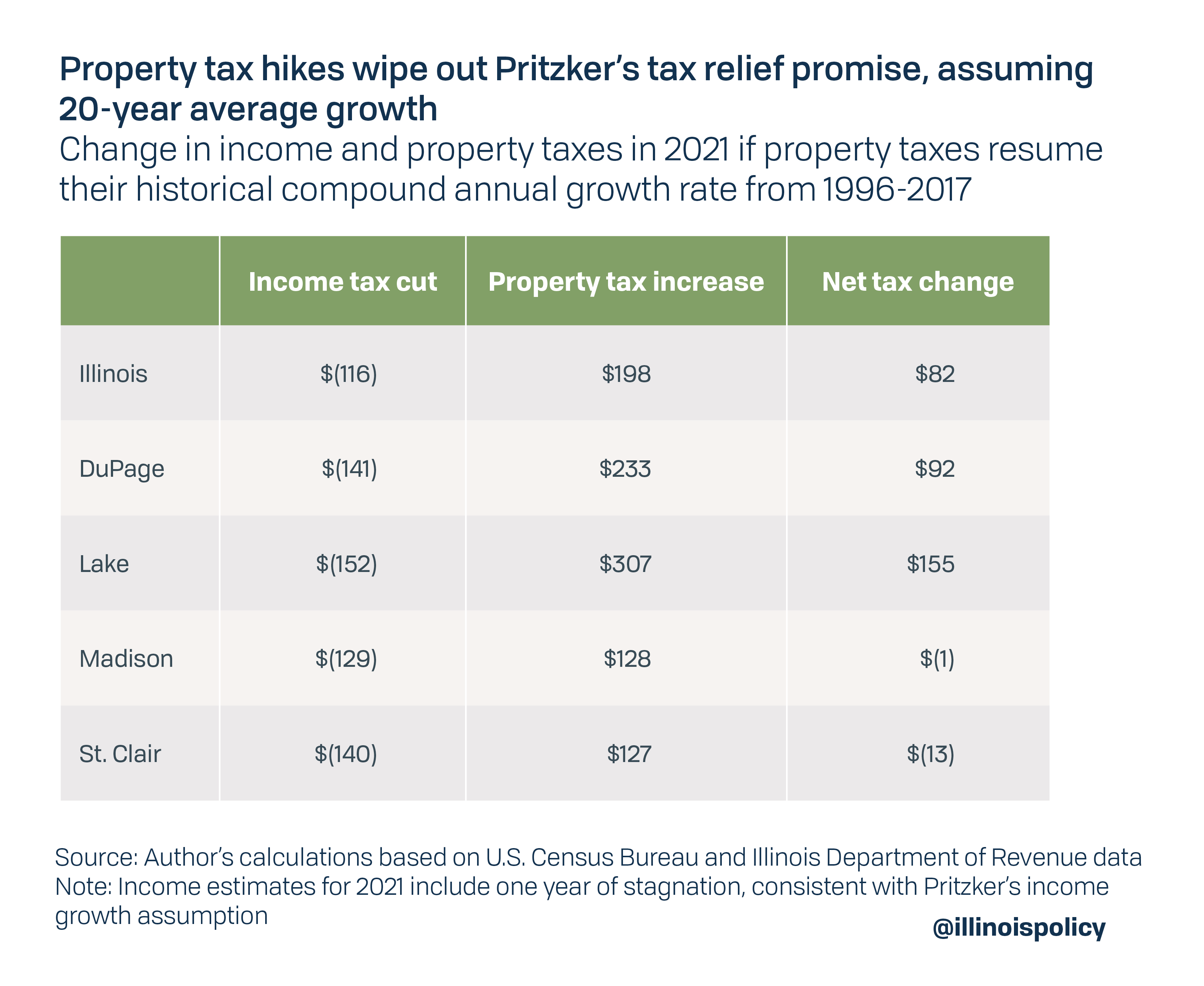

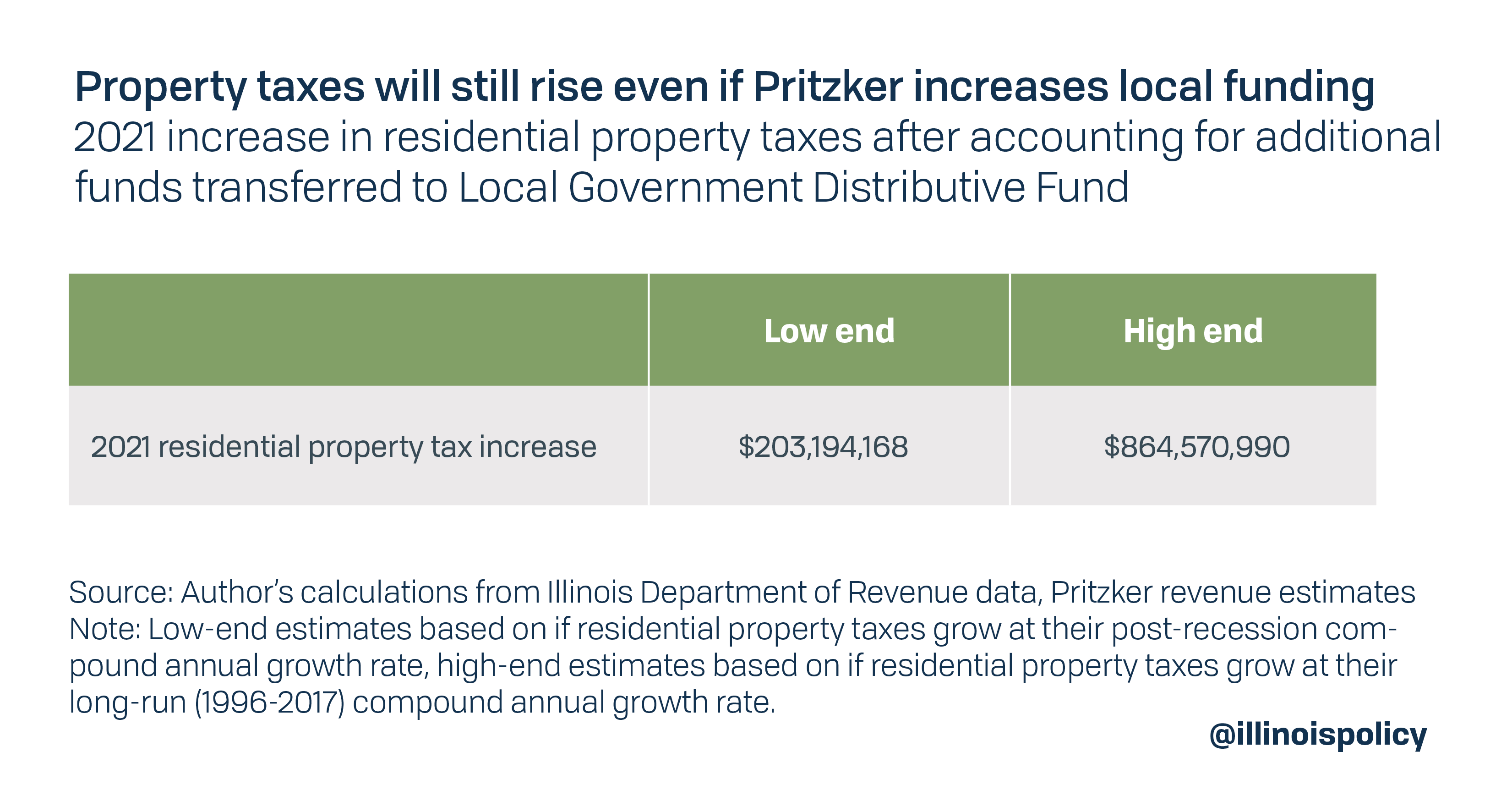

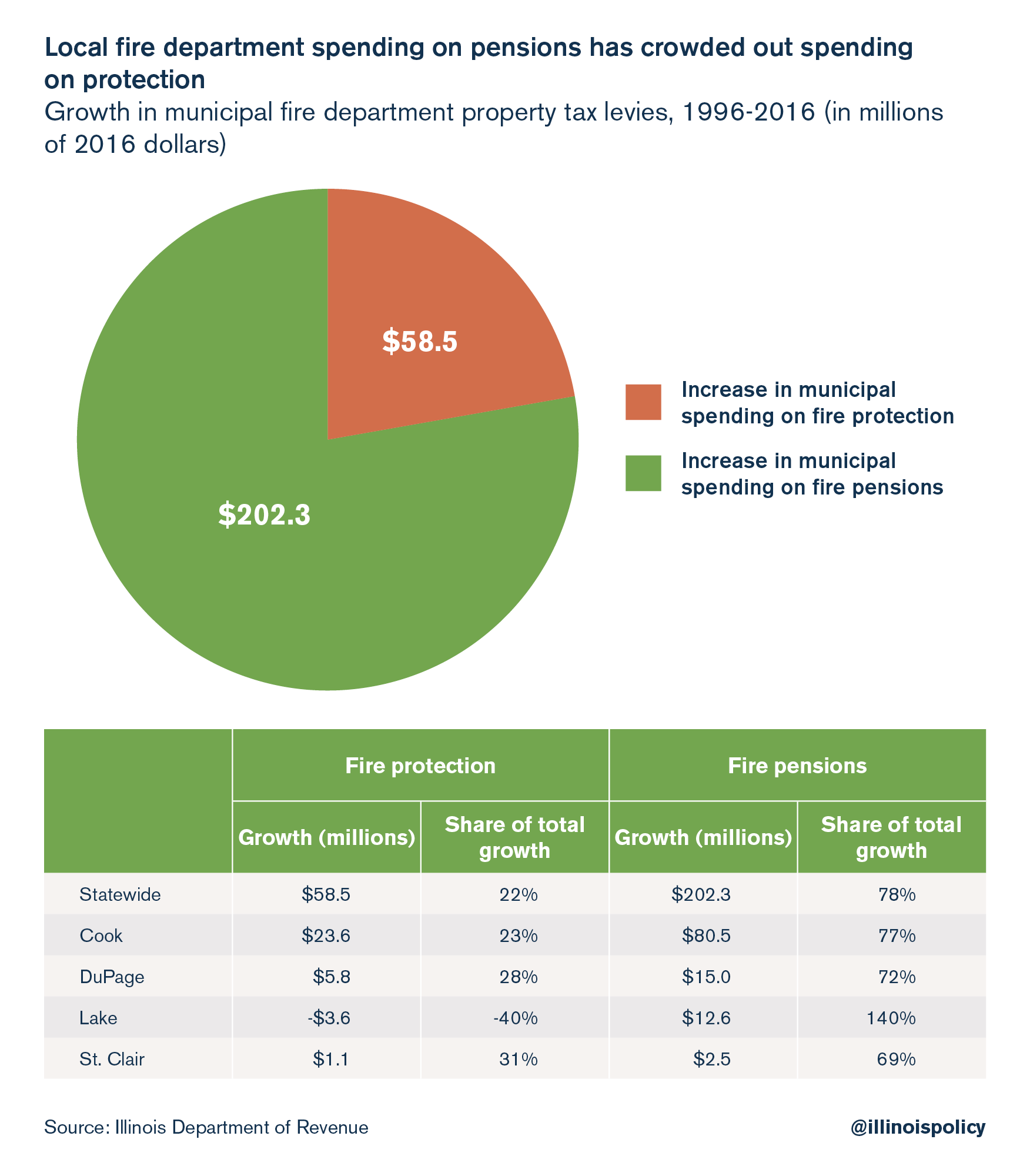

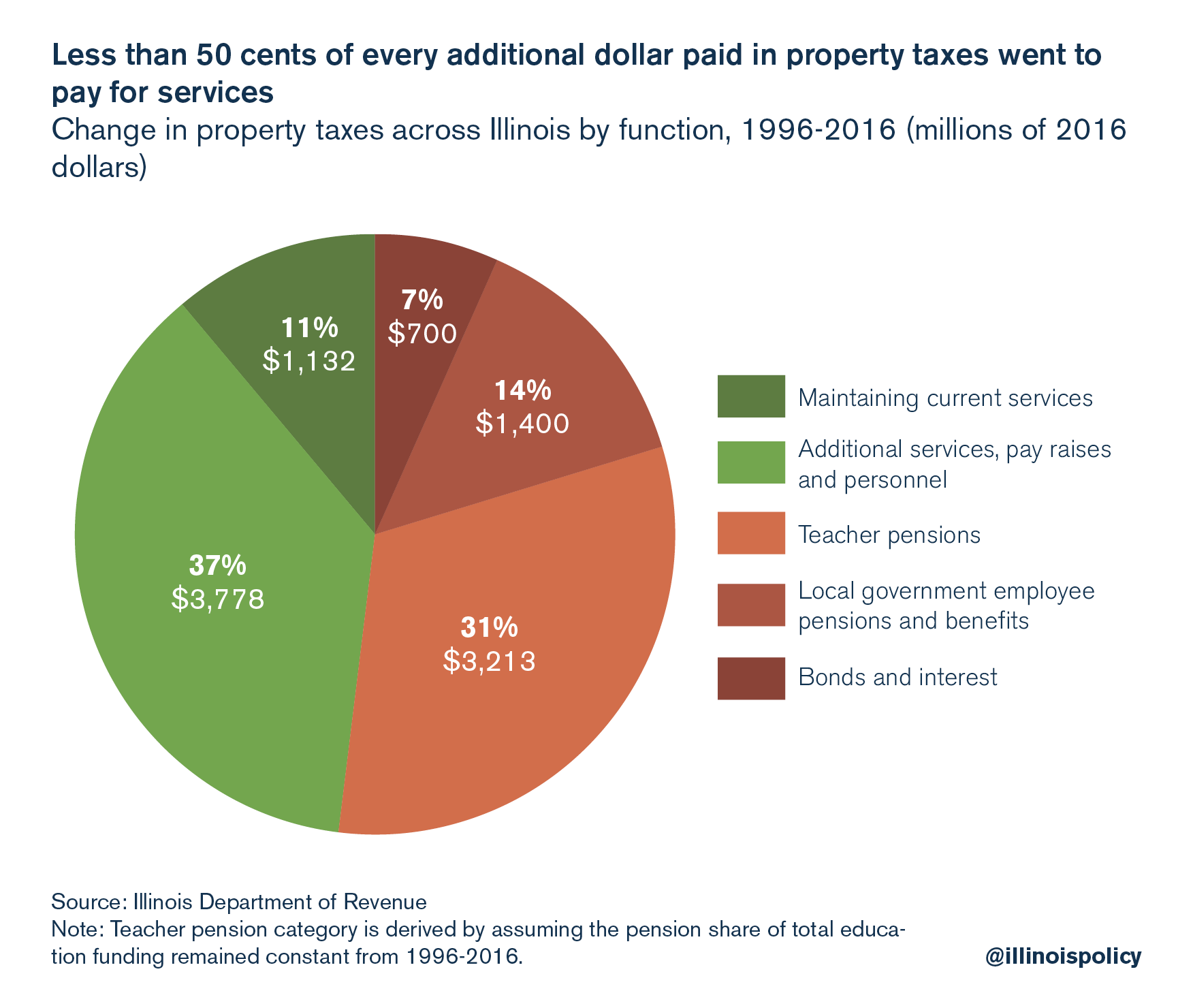

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

North Central Illinois Economic Development Corporation Property Taxes

Property Tax Village Of River Forest

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

Things That Make Your Property Taxes Go Up

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy